Run your entire funeral book from one secure, cloud platform

Create policies, onboard members, collect premiums, process claims instantly, and keep every record audit ready.

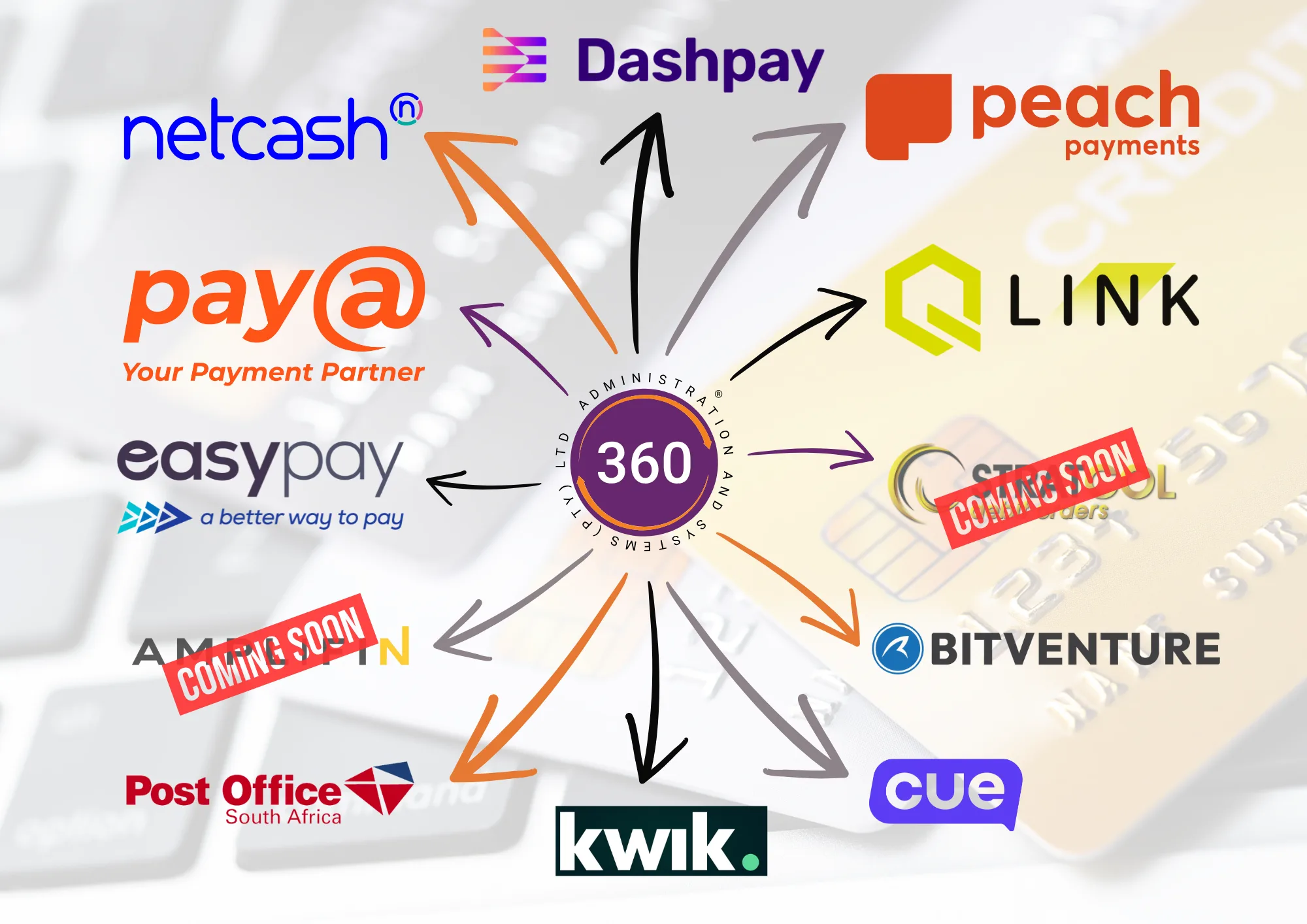

Collection methods and integrations

Flexible collections with multiple payment partners to reach members wherever they are.

Netcash, Pay@, EasyPay, Post Office South Africa, Dashpay, Peach Payments, QLink, Bitventure, Cue, Kwik, Stratcol.

Member Apps

Empower members with self-service tools and instant access to policy information.

Claim

Instant claims via automated checks and prebuilt integrations (e.g, DHA checks and account validation) to speed up payouts when families need it most.

Collections

Flexible collections with multiple payment partners to reach members wherever they are.

Chatbot

Self-service through our WhatsApp-powered chatbot for updates, documents and balances.

Dashboard

Real-time dashboards and reports for membership, premiums, arrears, lapses and claims.

The Future of FIC Act Compliance, Simplified.

Streamline your Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) obligations with the power of POL360, seamlessly integrated with our partners AI-driven compliance platform. We provide an effortless, end-to-end solution built for the South African financial market.

With the POL360-FinIntel integration, you can immediately benefit from:

-

- Automated Risk Categorization: Instantly run customer data through an intelligent platform to receive automated risk scores and categorizations that align with your Risk Management and Compliance Programme (RMCP) and the FIC's risk-based approach.

- Real-Time Screening: Conduct mandatory screening against global sanctions lists, Politically Exposed Persons (PEPs), Prescribed International Organisations (PIPs), and various risk-related datasets directly from the POL360 interface.

- AI-Powered Adverse Media: Leverage on our advanced artificial intelligence to continuously monitor and analyze adverse media, identifying potential high-risk indicators and feeding critical, real-time insights back into your POL360 client records.

- Seamless Ongoing Monitoring: Effortlessly transition from initial client verification to ongoing monitoring, with automated alerts ensuring you stay compliant as customer risk profiles change over time.

What you can do

Capture members and dependants in minutes and automate welcome comms. Paperless environment.

Set rules for waiting periods, grace periods and arrears workflows.

Automation of premium collection and claim collections and send smart reminders to reduce churn.

Approve claims fast with digital documents and automated validations.

Who is it for

Funeral parlours, administrators, brokers, insurers and hybrid businesses looking to scale without adding headcount.

Policy administration systems tailored for the insurance industry

Run your entire funeral book from one secure, cloud platform.

The Future of FIC Act Compliance, Simplified.

Streamline your Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) obligations with the power of Pol360, seamlessly integrated with our partners AI-driven compliance platform. We provide an effortless, end-to-end solution built for the South African financial market.

Create policies, onboard members, collect premiums, process claims instantly, and keep every record audit ready

funeral system with Netcash integration

white label funeral cover software

API funeral insurance platform

secure policy admin system South Africa

funeral policy system

funeral insurance software

funeral scheme administration system

funeral policy management system

funeral cover administration software

policy administration software South Africa

funeral insurance system provider

digital funeral policy platform

AI funeral policy system

insurance admin system funeral cover

best funeral policy software for brokers

funeral insurance system for small business

compare funeral policy admin systems

custom funeral insurance CRM software

web-based funeral policy management

automated funeral claim processing

integrated payment funeral cover system

SaaS funeral insurance platform South Africa

Policy Administration Software

Member Administration Software

Funeral Software

Insurance Software

EconoFunerals

Discover the power of 360 Administration and Systems for efficient Member Policy Management. Trustworthy, secure, and simple.

Letsatsi

Discover the power of 360 Administration and Systems for efficient Member Policy Management. Trustworthy, secure, and simple.

Netcash Payments

Discover the power of 360 Administration and Systems for efficient Member Policy Management. Trustworthy, secure, and simple.

A family drawn in white chalk under an umbrella on a black chalk

A family drawn in white chalk under an umbrella on a black chalkboard and a female hand, symbolizing the concept of security and insurance.

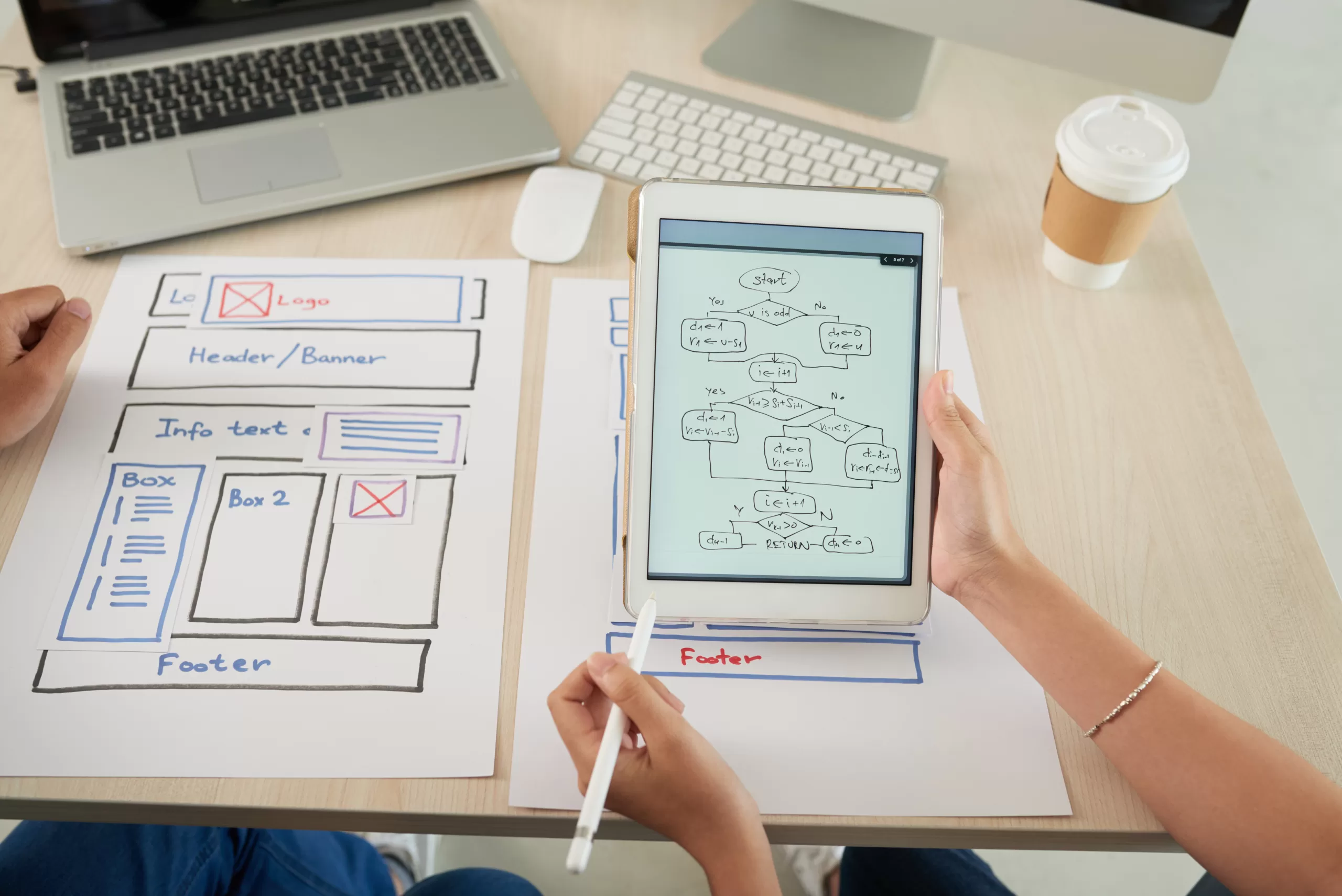

A woman’s hand holds a red marker on a beige background. Automat

A woman’s hand holds a red marker on a beige background. Automate business processes and workflows using flowcharts. Reduction of time for processing processes